Lenskart is reframing its future. Next week, the omnichannel eyewear giant will announce its foray into the smart glasses segment in partnership with semiconductor giant Qualcomm. So, what’s behind Lenskart’s new vision?

Beyond The Frame: Operating in a hyper-competitive and fragmented market, the eyewear giant sees the new product lineup as a bid to jazz up its product lineup with tech — AI, sensors or even a camera and enter high-margin categories. Besides, the push into the new segment could help Lenskart diversify beyond the traditional eyewear market and create a new revenue stream ahead of its IPO.

A “Smart” Playbook: Having been working on this product category for more than a year now, Lenskart has many aces up its sleeves:

- Qualcomm’s chip and spatial computing expertise to power the smart glasses

- Planned partnerships with at least two more tech giants to strengthen its technology stack

- Investments in XR startup Ajna Lens to integrate advanced features into the product

- Aggressive pricing strategy to take on Ray-Ban Meta Glasses head-to-head

- A vertically integrated ecosystem, including in-house manufacturing and supply chain, to drive efficiency and scale in its new product line

Taking On The Tech Titans: Lenskart’s strategic evolution into a consumer electronics company won’t be without its share of complexities. The foray into the smart glasses segment will pit it against tech behemoths like Xiaomi, Google and Samsung, which have spent years and millions of dollars trying to perfect their vision.

Then, there are the added challenges of supply chain constraints, developing the software that powers these glasses, providing after-sales service, and the capital required to achieve success in the smart glasses segment.

But, with its IPO just around the corner and little room for error, will Lenskart’s smart glasses move prove to be the next growth arc or a risky bet?

From The Editor’s DeskThe Stock Broking Gold Rush: With revenue from digital lending under stress due to stringent norms, fintech startups are looking at stock broking to boost engagement and top line. From JFS to MobiKwik and CRED, competition is lining up to take on Zerodha and Groww.

CodeParrot Shuts Down: The AI startup failed to sustain business due to excessive cash burn and its inability to raise more funds. Founded in 2022, it initially offered automation services to developers and later pivoted to a platform for generating user interfaces.

Prime Venture On Early Stage Maturity: Founded in 2012 with a modest $8 Mn corpus, the VC firm has grown to launch five funds and backed NiYO and MyGate. But, its fundamental thesis remains the same – everyone needs more than just capital.

JFS’ Q1 Profits Remain Flat: The Reliance-backed financial services giant reported a profit of INR 324.7 Cr in Q1 FY26, up 4% from INR 312.6 Cr in the same quarter of the previous fiscal. Meanwhile, operating revenues jumped 48% YoY to INR 612.5 Cr.

Smartworks’ Bumper Listing: The coworking major ended its maiden trading session on the BSE at INR 445.10, up 9.3% from the issue price of INR 407. The company opened on the stock exchange at a premium of 7.14% at INR 436.10 apiece on the BSE.

GreyLabs AI Eyes Funding: The GenAI startup is in talks to raise INR 76 Cr in Series A round likely to be led by Elevation Capital. GreyLabs offers a GenAI-powered platform for speech and text analytics.

IndiQube All Set For IPO: As per the managed coworking space startup’s RHP, it has cut the size of its fresh issue to INR 650 Cr while the OFS component has been halved to INR 50 Cr. The startup’s IPO will now open on July 23 and close on July 25.

Ullu Enters The Web3 Arena: The OTT streaming platform has launched a utility token designed to integrate blockchain-powered functionalities across its digital content ecosystem. Cypher Capital has backed the launch through a strategic early stage investment.

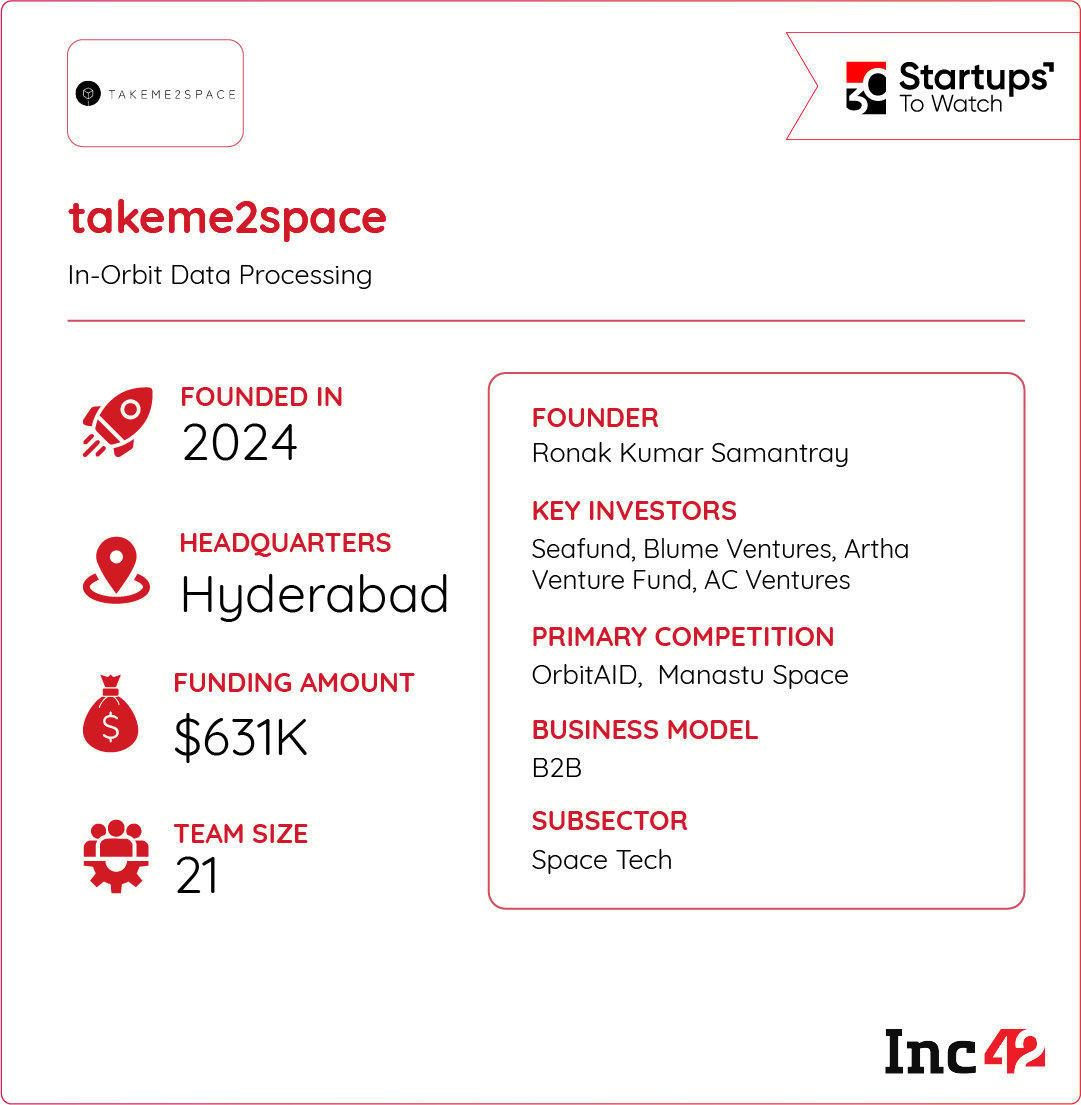

Inc42 Startup Spotlight Can takeme2space Make Space Research Affordable For All?Accessing space-based research tools and AI-powered data processing remains too expensive for many researchers, startups and SMEs in India. This cost barrier limits innovation and slows progress in Earth observation and space exploration.

Fixing What’s Broken: takeme2space is building affordable, AI-enabled satellite solutions. Its flagship platform, OrbitLab, allows users to upload AI models and process data directly in space on Low Earth Orbit satellites — all at just $2 per minute.

Why It Matters? By combining a pay-per-minute pricing model with in-orbit AI inferencing, takeme2space opens the door to low-cost, high-impact research for scientists and innovators. As India’s spacetech market is projected to hit $77 Bn by 2030, the startup is tapping into a rapidly growing segment ripe for disruption.

With rivals like Orbit AID and Manastu Space on its tail, can takeme2space capitalise on its affordability edge and AI tech to democratise spacetech?

The post Lenskart Adds Smart Glasses To Cart, The Stock Broking Gold Rush & More appeared first on Inc42 Media.

You may also like

MAGA move: Trump admin axes LGBTQ youth suicide hotline; critics warn 'kids will die'

'Zero tolerance for terrorism': Jaishankar hails US move on Lashkar proxy TRF; calls it strong India-US coordination

Tillotama Shome's 'Baksho Bondi – Shadowbox' to open IFFM 2025

Priyanka Chopra: A Journey from Bollywood to Global Stardom

Amarnath Yatra resumes from Jammu as 7,908 leave for Kashmir