Eternal is torn between Zomato and Blinkit. As soon as one stabilises the other one hits a snag. And as the Q2 results show, Eternal is banking on food delivery for profits and quick commerce for growth.

But this balancing act is proving harder to achieve than many might have expected last year.

The company’s operating revenue surged to INR 13,590 Cr, a massive 183% jump from the same quarter last year. But profits took a sharp nosedive of 63% year-on-year to INR 65 Cr. Even though net profit more than doubled on a QoQ basis from INR 25 Cr, one would have expected a higher uptick given that Q2 is the start of the festive season, historically a big quarter for Zomato.

In Q2, Blinkit was the clear standout for Eternal, driving the revenue surge single-handedly with a whopping 756% surge (INR 9,891 Cr in Q2 FY26 vs INR 1,156 Cr in Q2 FY25) thanks to the inventory-model pivot.

But it’s Zomato that seems to be the problem child for the Deepinder Goyal-led consumer services giant.

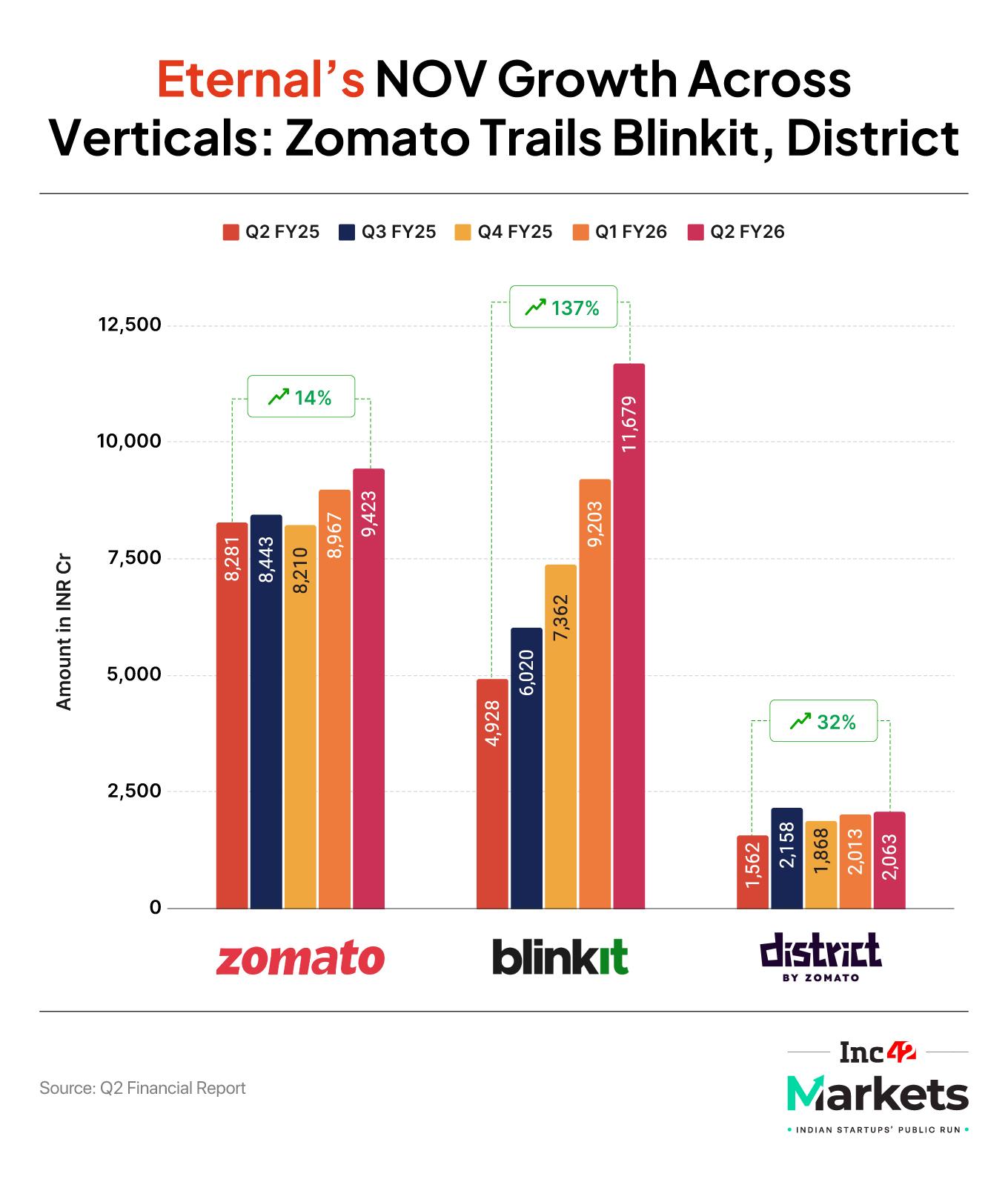

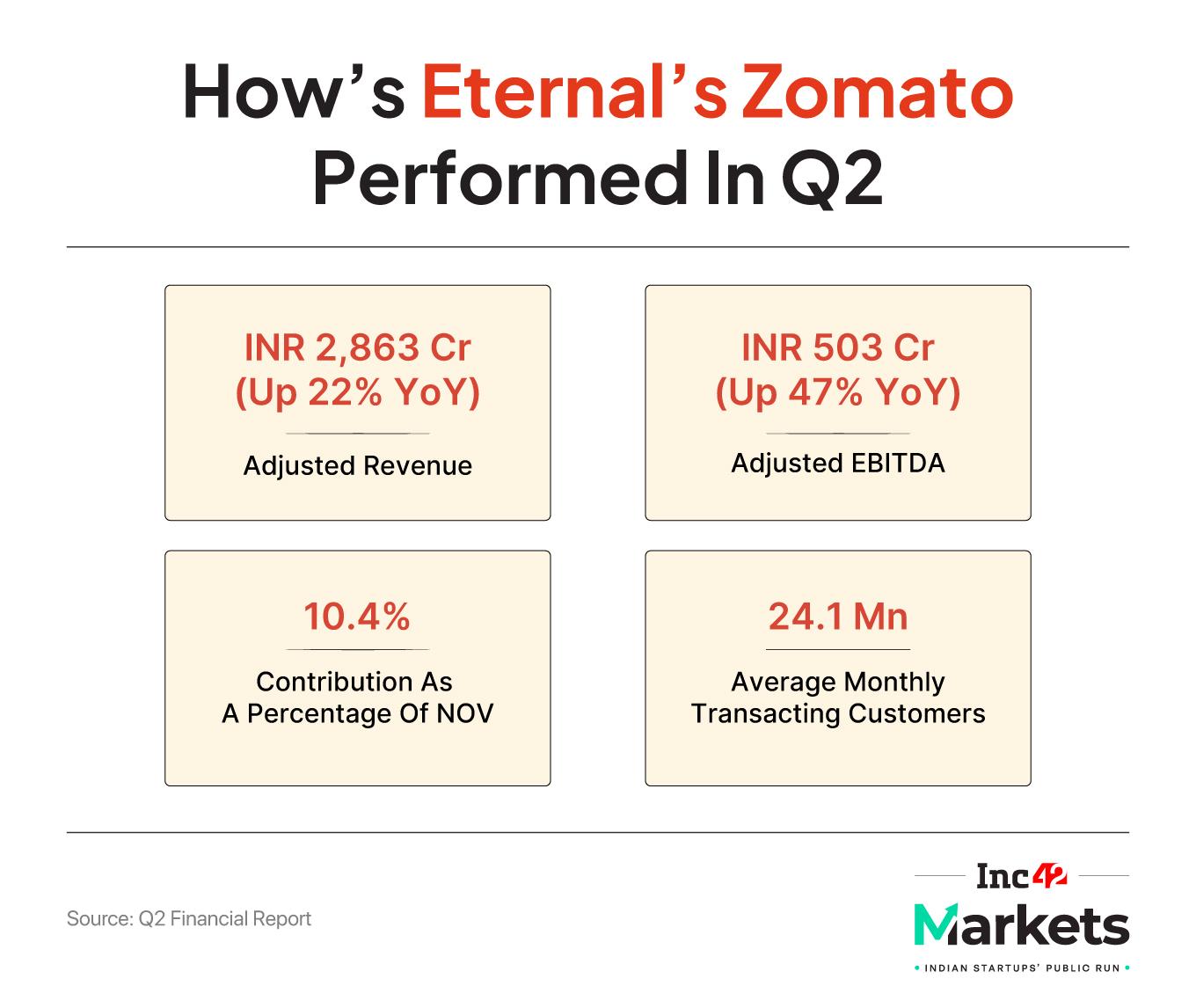

After five straight quarters of slowing expansion, Zomato’s net order value (NOV) finally ticked up during the quarter, albeit slowly. Food delivery NOV grew 14% YoY, improving slightly from 13% YoY NOV growth in the previous quarter.

Deepinder Goyal has acknowledged that growth recovery has been slower than expected, elaborating that Zomato is dealing with multiple challenges, including muted discretionary spending in India and increasing pressure from the quick commerce segment boom.

The market was not too pleased with the results. Eternal’s shares slipped over 4% to INR 333.75 on the BSE during intraday trading. It later recovered, but ended the week in the red at INR 342.7.

Zomato Squeezed By Consumption ChillEternal has already started taking measures to reposition itself as a broader lifestyle platform since last year, as a necessary response to a slowing core food delivery business. One could say that Zomato’s slow growth was foreshadowed by those moves, which included the launch of District and Bistro by Blinkit.

Building on Blinkit’s rapid success, the Zomato parent aimed to become an essential part of consumers’ daily lives.

With District, launched in November 2024, Zomato increased focus on enhancing the going-out experience—connecting users to restaurants, events, and nightlife.

Meanwhile, Bistro, launched in December, caters to instant food cravings, complementing its delivery network. Together, these two products positioned Eternal as a comprehensive ecosystem that blends dining, social experiences, and convenience, reinforcing its vision of being the go-to lifestyle companion for urban consumers.

But this flywheel only works when consumption patterns remain consistent in the economy. Let’s contextualise this with the margins for Zomato.

In Q2, food delivery adjusted EBITDA fell 47% YoY to INR 503 Cr, and revenue rose 24% to INR 2,485 Cr. While profit for the quarter climbed 49% to INR 518 Cr, the underlying story is one of margin pressure and muted demand.

The take rate improved by 75 basis points, supported by stronger ad monetisation, higher commissions, and platform fees. A reading of the disclosures shows that the contribution margin grew by only 50 basis points, as gains were partly offset by lower delivery charges.

A key reason for this adjustment was Zomato’s decision to lower the minimum order value for free delivery under its Gold programme – from INR 199 to INR 99 – in an attempt to reach price-sensitive consumers. While the move makes the platform more accessible, it also reflects the broader economic reality: Indian consumers are tightening their wallets.

The food delivery segment continues to face sluggish growth, and the company expects this trend to persist in the near term. High inflation, a prolonged heatwave, and erratic monsoons have all dampened consumer sentiment and reduced order frequency. Even during the festive buildup, order volumes remained flat to marginally higher quarter-on-quarter.

The macro picture offers little relief. According to theIndus Valley Annual Report 2025 by Blume Ventures published earlier this year, nearly a billion Indians – about three-quarters of the population – have no disposable income left after meeting basic expenses.

Over 70% of households are spending almost all their income on essentials like food, rent, and healthcare, leaving little room for indulgences such as online food delivery.

GST 2.0 Adds To Zomato’s Woes

Zomato isn’t just fighting a slowdown in consumer spending; it’s also dealing with new regulatory headwinds. The rollout of the new taxation framework, GST 2.0, has added another layer of pressure.

After years of ambiguity over how delivery charges should be taxed, the GST Council finally introduced a new category called “local delivery services”. It’s split into two parts: one for general local deliveries (already taxed at 18% with input tax credit) and another specifically for deliveries made through ecommerce platforms — which directly impacts foodtech players like Zomato and Swiggy.

Under the new rules, these companies now need to pay 18% GST on delivery charges whenever the delivery partner isn’t GST-registered.

The 18% GST now applies to delivery fees charged to customers, affecting roughly a quarter of Zomato’s orders — the ones where delivery isn’t free. While the platform fee was already taxed, this new rule adds a fresh cost layer to every paid delivery.

Akshant Goyal, chief financial officer of Eternal, disclosed in the Q2 shareholder letter that Zomato has seen a slight negative impact on order growth, as the platform has chosen to pass this extra tax burden on to customers.

For users, the pinch is becoming more noticeable, especially since both Zomato and Swiggy raised their platform fees again last month. When you combine higher platform fees with an additional 18% GST on deliveries, the outcome is as expected: online food delivery just got a bit more expensive.

And with the festive season approaching, that’s not exactly the kind of surprise consumers were hoping for, according to the consumer market experts that we spoke to.

Rising Competition In The Budget SegmentWhile overall competitive intensity in the food delivery space has cooled slightly, new entrants are starting to shake things up again, this time by going after budget-conscious consumers, a segment that’s becoming increasingly important as discretionary spending weakens.

Swiggy recently rolled out a separate food delivery app called ‘toing’, aimed squarely at the affordable meals market. Although still in its early stages, ‘toing’ signals Swiggy’s intent to segment its audience more sharply and capture value-driven users who may be ordering less frequently through premium platforms.

Adding to the mix, Rapido has entered the fray with Ownly, its own food delivery platform positioned as a low-cost alternative to Zomato and Swiggy. Ownly currently charges no platform fees, directly undercutting incumbents who have steadily increased these fees in recent months.

Zomato, meanwhile, has chosen not to launch a separate app for the mass-market segment, at least for now.

Instead, it’s betting on tweaks within its existing platform, to make smaller, lower-value orders more affordable and keep price-sensitive users within the Zomato ecosystem.

The company said that introducing another app to target budget users would add operational complexity and prefers to “wait and watch,” even if it means being the last mover.

Eternal’s Twin EnginesAs usual, Eternal has presented an optimistic picture in its shareholders letter. And this bullishness is reflected in the market sentiment for the Eternal stock, despite slow growth in food delivery.

Motilal Oswal has retained a target price of INR 410, implying nearly a 20% upside from current levels. The brokerage is bullish on Eternal’s leadership in quick commerce and food delivery, as well as the long-term potential of Blinkit.

“Eternal looks bullish as it is currently trading above its 50-day moving average. Support for the stock is at around the INR 320-325 level, and it is advised to buy in this range. The target is at INR 355-360, with support below INR 300,” said Jigar Patel, senior manager of equity research at Anand Rathi, adding that the stock is expected to see a bull run in the next week.

According to Sourav Choudhary, MD of Raghunath Capital, over the medium term, quick commerce will ultimately drive Eternal’s trajectory. “Food delivery is maturing and will likely serve as a cash-flow base,” he said, adding Blinkit has the potential to capture India’s urban consumption growth.

Overall, food delivery is expected to act as a stabiliser, generating steady cash flows rather than driving primary growth. Meanwhile, quick commerce and strategic initiatives provide the potential for incremental expansion, supporting a positive medium and long-term outlook for Eternal.

But for how long can Blinkit keep cushioning Zomato’s sluggish growth momentum?

Markets Watch: New Deals, Results And More- MapmyIndia Gets Govt Backing: Union minister Ashwini Vaishnaw said that Indian Railways is partnering with the geotech company for its homegrown navigation app Mappls, giving a boost to its shares, too

- JFS’ Q2 Numbers: Jio Financial Services posted a 42% on-year jump in operating revenue jumped to INR 981.4 Cr, while profit remained flat at INR 695 Cr

- TAC Infosec’s Stellar H1: The NSE SME-listed cybersecurity company posted a 138% YoY surge in net profit to INR 15.6 Cr H1 FY26, as operating revenue also jumped 137% to INR 29.5 Cr

- IndiaMart Q2: The B2B ecommerce company saw its net profit crash 39% YoY to INR 82.7 Cr in Q2 FY26, even as operating revenue rose 13% YoY to INR 391 Cr

- Justdial’s Profit Falls: Its net profit declined about 23% YoY to INR 119.4 Cr while operating revenue rose 6% to INR 303.1 Cr.

[Edited by Nikhil Subramaniam]

The post Eternal’s Zomato Conundrum appeared first on Inc42 Media.

You may also like

Smriti Mandhana Takes Responsibility for India's Narrow Defeat Against England in World Cup

Sheikh Mohammed extends warm Diwali wishes to Indian community in UAE and worldwide

We live in the UK's friendliest city - 1 thing makes it better than anywhere else

'Shouted, cursed, and tossed maps': Trump urged Zelenskyy to accept Putin's terms or be 'destroyed' — Inside US meeting with Ukraine

How India can still qualify for Women's World Cup semifinals after defeat to England - scenarios explained